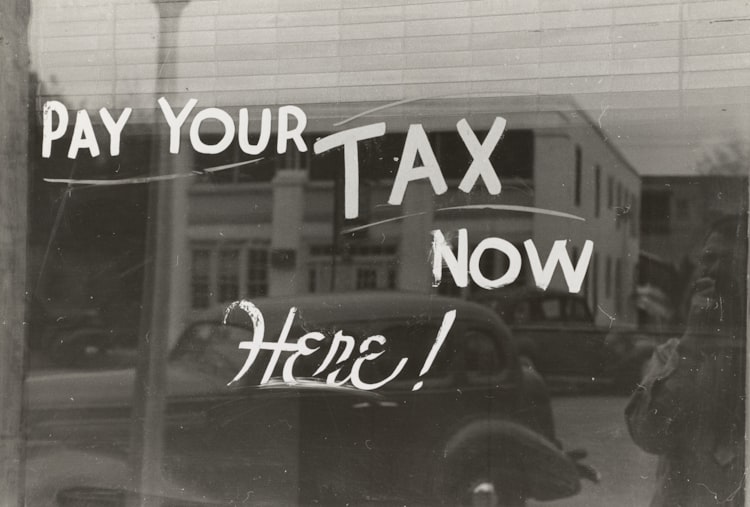

Fee protection

HMRC's Connect system currently selects nine out of every ten enquiries and is designed to identify those who may have paid too little tax. Even if you have done nothing wrong, anyone can be selected - meaning no one is immune to scrutiny.

Why do you may need tax investigations protection?

Following the merger of various departments within HMRC - all of the government departments have merged including tax credits - information is now seamlessly transferred into your tax file using your national insurance number e.g. benefits, bank interest, property transactions, and rental income are all reported directly to HMRC by the benefits agency, the banks, the land registry and property management agencies respectively.

Tax is becoming digital

In addition, HMRC is in the process of changing to Making Tax Digital (the reporting of income on a quarterly basis using software). Therefore they will be more readily able to access the income and expenses shown on the profit and loss account of a business, together with the rental income received by both individuals and businesses. This information is likely to throw up more discrepancies.

Anyone can be selected

HMRC's Connect system currently selects nine out of every ten enquiries and is designed to identify those who may have paid too little tax. Even if you have done nothing wrong, anyone can be selected - meaning no one is immune to scrutiny.

As a result, it is more likely that an investigation by HMRC into your affairs could arise in the future. Therefore we do advise our clients to consider taking up our annual tax investigation service.

Protect yourself

Subscribing to our Tax Investigations Service means we will:

- Respond to HMRC on your behalf and provide you with full representation

- Handle all correspondence and meetings with the tax inspector

- Deal with the tax authorities and prepare and defend your case fully

- Give you peace of mind that professional representation costs are covered